Saving Our Retail Corridors Requires Good Data

On June 22nd, New York City entered the second phase of its post-COVID reopening,

which allows restaurants and bars to reopen with a simple self-certification process for outdoor dining. As of the

time of publication,

businesses had already completed the application process; it remains to be seen the extent to which this action

will help businesses stay afloat and what corridors will fare best. While there are many policy tools that could

have broad benefits for small business, we believe effective recovery strategies will need to focus on short-term

reactivation strategies – and those will need to be tailored to local conditions.

HR&A partnered with

Live XYZ, a New York City-based startup that delivers

precise, complete storefront and point-of-interest data and technology. Through Live XYZ’s proprietary mapping

methodology, it has created a hyper-accurate map of places and how they change over time. Leveraging Live XYZ’s

data set on conditions pre-COVID, HR&A analyzed retail conditions in three New York City neighborhoods to

understand their vulnerabilities and adaptability.

Live XYZ’s unique data captures the use and business located within every single storefront in New York City,

allowing us to do a granular analysis of corridor conditions.

Our Thesis

Retail streets that are reactivated most quickly will have the greatest chance of thriving again. The

three retail strips we examined are very differently positioned for reactivation. To shape an equitable retail

corridor recovery, cities will need access to accurate, complete, and trustworthy data on city storefronts to

develop tailored, high-impact, equitable strategies for retail corridor reactivation and recovery post-COVID.

The Neighborhoods

Jackson Heights

Jackson Heights, Queens is one of the most diverse neighborhoods in the country - middle-income with a

large number of South American and Southeast Asian residents, many foreign-born. The neighborhood

attracts shoppers from across the city seeking international goods; to the extent that transit use regains

acceptance, Jackson Heights should continue to attract regional shoppers.

More local shopping may be constrained: the borough’s

COVID case rate is

1.6 times the citywide average, and its

unemployment

rate has more than tripled to 16.4%. The many immigrant-owned businesses are likely to have had

difficulty securing Paycheck Protection Program (PPP) loans or other relief.

The Hub

The Hub in the Bronx is a bustling shopping destination for many Bronx residents. The

immediately

surrounding neighborhood – a community of color with 67% Hispanic and 29% black residents – has a 46%

poverty rate, one of the highest rates in the city.

The borough’s

COVID

case rate is higher than the citywide average, and its

unemployment rate increased from 4.9% to 16.5% between

January and April 2020. These devastating impacts may limit both the neighborhood and other Bronx consumers’

ability to support Hub businesses.

Madison Avenue

Madison Avenue in Midtown Manhattan serves both office workers and high-income residents. The majority

of neighborhood residents are white, and

the borough’s COVID case rate is

well below the citywide average. Manhattan

unemployment has increased less than in the other

boroughs.

While high levels of prosperity would suggest faster recovery,

shifts to remote work could mean a

decline in office workers that frequent these stores. Residents in wealthier New York City neighborhoods have

left in

greater numbers –

an estimated 30% of residents left this neighborhood – raising the question of

whether the residential customer base will be diminished.

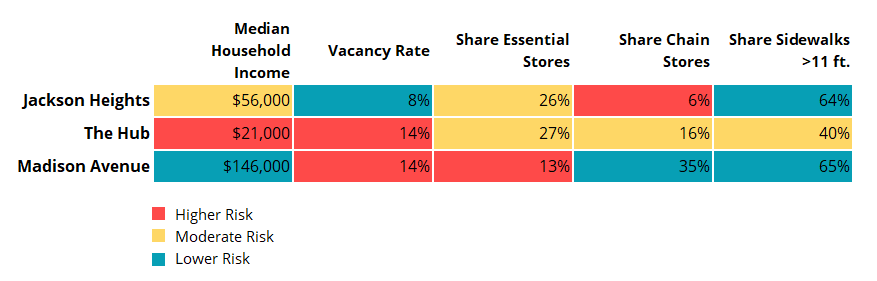

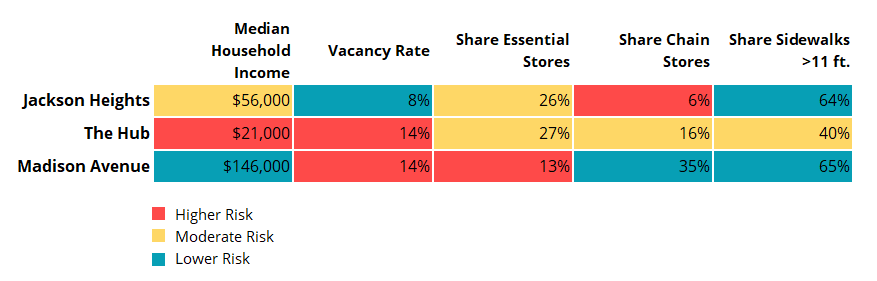

The Odds for Short-Term Reactivation

We examined four surrogates for capacity to reactivate a retail strip – pre-existing vacancy, percentage of

“essential” businesses, which were never required to close; percentage of chain stores, with

presumably deeper pockets; and ability to take advantage of loosened outdoor seating regulations. Among

that set of potential risk factors, The Hub, Jackson Heights, and Madison Avenue all have different

combinations of strengths and weaknesses. While we fear that corridors in the most vulnerable communities will

suffer the most, we also identified areas of strengths in the Hub and weaknesses on Madison Avenue.

Storefront Vacancy

According to the

NYC

Department of City Planning, prior to COVID,

storefront vacancy rates varied widely across

neighborhoods. If vacancy rates increase post-COVID, corridors starting out with lower vacancy may bounce back

faster, attracting consumers to more activated streets.

Essential Businesses

Essential businesses may be more likely to survive, since they never closed and may provide goods

consumers are less likely to seek online. They could provide a baseline of strength upon which retail

corridors can build.

Essential services include auto dealers & repair, banks & ATMs, beauty product stores, bicycle repair and

stores, gas stations, groceries & convenience stores, hardware & home improvement stores, laundry/dry cleaners

& tailors, liquor & wine shops, pawn shops, pet stores, pharmacies, printing & shipping/postal services,

vapes/cigars & accessory shops, vitamin & supplement stores, and other listed in

New York State’s essential services definition,

with the exception of hotels, which this analysis excluded.

Chains

Chains, i.e. businesses with more than five same-named establishment in NYC,

may be more resilient

post-COVID compared to independent retailers; approximately

one half of small businesses have only one to two months

of cash on hand. Corridors with relatively high percentages of chains could be buoyed, although the outcome

would be an even greater concentration of chains and loss of retail character.

Physical Adaptability

Restaurants and bars can now easily

create outdoor seating on sidewalks or in parking spots. While

indoor dining was expected to be permitted under the third phase of reopening, which began on July 6th, the

city has changed course due to a rapid increase COVID-19 cases across the country. Outdoor dining will

continue to be critical for ongoing restaurant revenues.

However, to maintain required clearance for pedestrians, sidewalk seating is only permissible on

sidewalks 11 feet or wider.

Less than half of such establishments in the Hub can create sidewalk seating. In Jackson Heights and on

Madison Avenue, almost two-thirds of these businesses can create sidewalk seating.

Conclusion

Retail corridor recovery will be driven by a confluence of many factors with different levels of impact. Among the

potential risk factors we analyzed,

The Hub, Jackson Heights, and Madison Avenue all have different combinations

of strengths and weaknesses. However, the multiple indicators we analyzed suggest that the Hub may be the

least resilient of the three – unfortunately no surprise given that this is also a low-income community of

color.

Support for the Hub should address the devastating toll that COVID-19 has had on the community.

Support for the Hub should address the devastating toll that COVID-19 has had on the community. We should

track the supply of essential retail services for resource-constrained residents who may have more limited ability

to access other neighborhoods and provide targeted support for these businesses, based on their identification of

need, such as loosened access to credit and support for rent renegotiation.

Jackson Heights’ small, immigrant-owned businesses may have particular trouble navigating recovery resources and

red tape. We should assess their challenges and provide technical assistance, as needed, for challenges such

as accessing emergency loans or adapting business operations to comply with new social distancing

requirements.

On Madison Avenue, if office workers and/or residents permanently decamp, the prior mix and amount of retail may

no longer be viable. Midtown contains many large buildings in which ground floor retail generates a relatively

small share of rent. The City might encourage property owners to acknowledge retail may not be the rent generator it

once was, fill spaces with experiential uses, and/or offer lower-rent spaces to small retailers to activate the

street.

This crisis is unprecedented and these ideas will need to be tested based on outreach to retailers and continued

data review and analysis.

We will need data such as Live XYZ’s to undertake

that testing and provide corridors with the tailored support they need.