HR&A is supporting urban leaders in 100 cities across the United States as they develop comprehensive, actionable plans to become more resilient to social, economic, and physical risks and challenges.

HR&A supports the 100 Resilient Cities program, a global initiative pioneered by The Rockefeller Foundation, and Chief Resilience Officers across the United States as they develop comprehensive resilience strategies and implementation plans that respond to their cities’ unique set of risks and long-term vision and goals. Each strategy and implementation plan is designed to build the capacity of individuals, communities, institutions, businesses, and systems within a city to not only survive a major disruption event such as an earthquake or flood, but also to adapt and grow in the face of chronic stresses such as poverty or housing availability.

HR&A works with each Chief Resilience Officer and other senior officials to develop comprehensive resilience strategies.

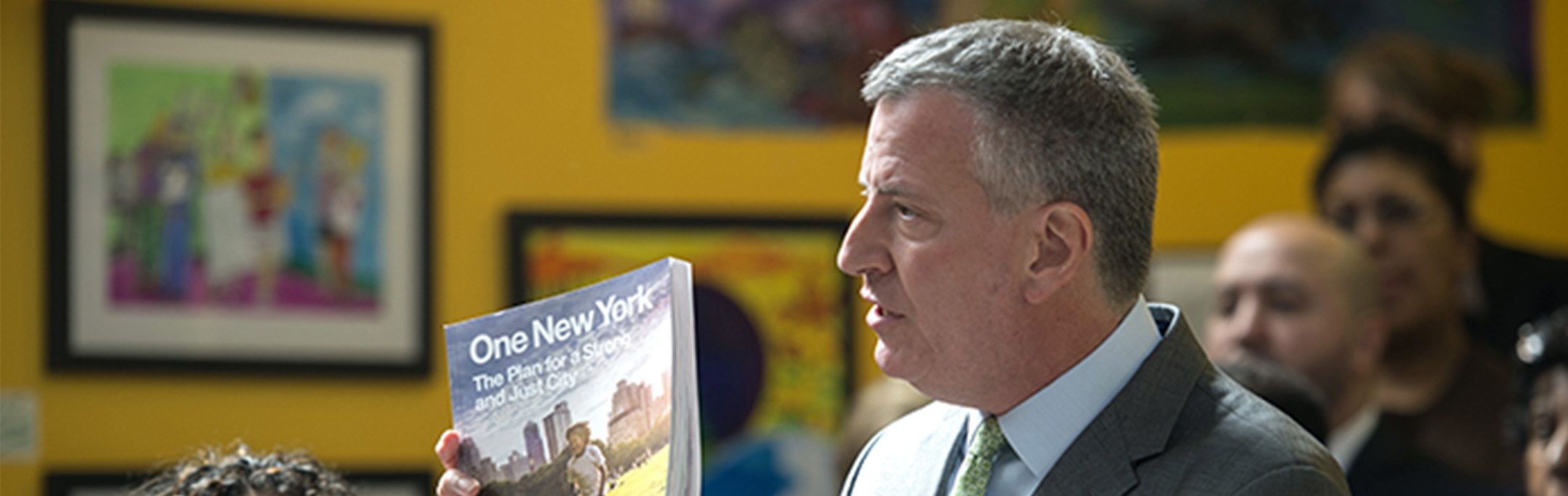

At the forefront of Resilience Strategy Development, HR&A has supported the comprehensive strategic plans for Norfolk, New York City and New Orleans – the first to be delivered as a part of the 100RC program. In Norfolk, HR&A worked with the Chief Resilience Officer (CRO) to design initiatives that will make the coastal city more prepared for climate change, create economic opportunity in new and growing sectors, and strengthen communities and neighborhoods while deconcentrating poverty. New York City’s strategy, developed with support from HR&A, envisions a more resilient city embracing balanced growth, a more inclusive economy, sustainability in the face of climate change, and more resilient infrastructure and services. In New Orleans, HR&A supported the CRO in prioritizing initiatives advancing coastal protection and restoration, creating equity through opportunity, and redesigning regional transit systems. Future strategies may include the development of high priority implementable projects and initiatives that strengthen infrastructure, generate economic opportunity, improve governance structures, and build social capital.

Through the Resilience Strategy Development process, HR&A supports cities and CROs to:

- Identify and prioritize potential acute shocks and chronic stresses that their cities face;

- Provide thought leadership by guiding use of best practices and delivering data-driven analyses;

- Coordinate and facilitate stakeholder workshops; and

- Design a Phase-1 Resilience Strategy

HR&A led agenda-setting workshops for six of the ten selected North American cities: Los Angeles, California; Norfolk, Virginia; Boston, Massachusetts; Boulder, Colorado; Tulsa, Oklahoma; St. Louis, Missouri; and El Paso, Texas. Prior to each workshop, HR&A analyzed the city context, including demographic, economic, social, and physical metrics, to define a city-specific strategic plan. Learn more about the program at 100resilientcities.org