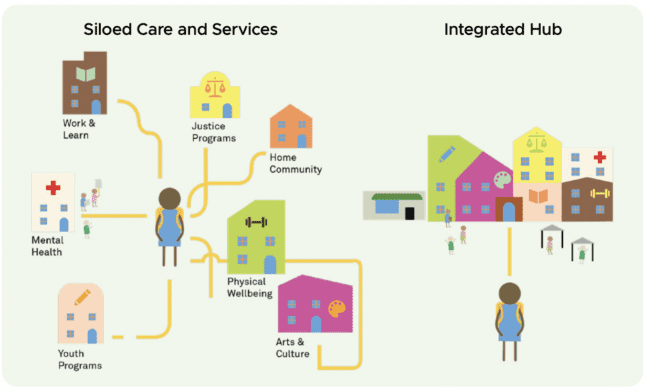

The Los Angeles County Department of Consumer and Business Affairs selected HR&A to provide recommendations for a potential Tenant Opportunity to Purchase Act (TOPA) policy for unincorporated areas in LA County, which aims to prevent displacement, preserve affordable housing, and increase homeownership opportunities for renters. HR&A developed a set of preliminary recommendations on program design and implementation strategies, including the required ecosystem, funding support, staffing costs, and data tracking needs.

The Department of Consumer and Business Affairs (DCBA) engaged the HR&A Advisors team, which included LISC LA and Change for Good Consulting. The team facilitated workshops with County stakeholders to discuss program goals and policy priorities, as well as external stakeholders, including tenant advocates, property owners, and real estate and affordable housing industry experts, to gather information and conduct desktop research and interviews with jurisdictions with precedent programs. Incorporating these inputs along with best practices, HR&A summarized a set of preliminary recommendations on program design and implementation strategies.

The final report provides a summary of the context and needs for a potential TOPA program, along with preliminary program design and implementation recommendations on how the policy could support tenant protection, anti-displacement, and expand ownership access for L.A. County unincorporated areas.

Explore